Adani Group Stocks Soar: Robust Gains and Investor Optimism Propel Adani Share Prices of the Adani Group

In a remarkable surge, Adani Group’s energy companies experienced substantial gains, propelling the S&P BSE Power index to an intra-day high. Adani Green Energy (AGEL) took centre stage, hitting an upper circuit limit with a two-day gain of 31%, reaching Rs 1,348. This surge was driven by investor optimism surrounding the increasing power demand linked to economic improvements.

The rally coincides with AGEL’s announcement of a substantial funding initiative of $1.36 billion for the development of the world’s largest renewable energy park in Khavda, Gujarat. This strategic move is set to significantly boost the company’s capacity in the renewable sector.

Despite earlier challenges, including controversies and short-seller reports impacting Adani Group’s share market value, the recent surge in stock prices indicates a positive turn. The company’s total market capitalization has now crossed Rs 12 lakh crore, signalling a strong investor sentiment.

Adani Group: Key Developments Fuel Surge in Stock Prices

Adani Green Energy's Strategic Funding Initiative: Fueling the World's Largest Renewable Energy Park

In a groundbreaking move, Adani Green Energy (AGEL) share price has dedicated a strategic funding initiative totalling $1.36 billion. This substantial financial commitment is earmarked to bolster the development of what promises to be the world’s largest renewable energy park, located in Khavda, Gujarat.

The primary focus of this funding initiative is to facilitate the rapid expansion of the renewable energy park. AGEL aims to enhance the park’s infrastructure, ensuring it becomes a state-of-the-art facility capable of harnessing significant clean energy potential.

A substantial portion of the funds will be allocated to integrating cutting-edge technologies within the renewable energy park. AGEL envisions leveraging advanced solutions to optimize energy generation, storage, and distribution, establishing the park as a technological benchmark in the renewable energy sector too.

AGEL’s ambitious plan involves a significant increase in the park’s overall capacity. The infusion of funds will support the addition of new renewable energy assets, including solar and wind projects, further solidifying the park’s standing as a global leader in clean energy generation.

Beyond its renewable energy objectives, AGEL anticipates that the funding initiative will result in substantial job creation. The development and expansion of the renewable energy park are poised to stimulate economic growth in the region, fostering a positive socio-economic impact.

Adani Green Energy’s strategic funding initiative for the Khavda renewable energy park marks a significant milestone in India’s clean energy journey. As the project unfolds, it has the potential to reshape the country’s renewable energy landscape, setting new standards for innovation, sustainability, and global leadership in the sector.

NTPC's Stellar Performance Ignites Positive Sentiment in Power Sector

In a recent surge, NTPC (National Thermal Power Corporation) has emerged as a standout performer, significantly elevating the overall sentiment in the power sector. The company’s exceptional performance, marked by a new high on the Bombay Stock Exchange (BSE), has instilled optimism and enthusiasm among investors and industry analysts alike.

The surge in NTPC’s performance is closely linked to its ambitious plans for expanding renewable energy capacity. The company’s commitment to adding substantial renewable assets has resonated positively with investors, contributing to the surge in its stock value.

Analysts from ICICI Securities have noted that NTPC’s recent strides are expected to drive significant growth in EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and Profit After Tax (PAT). This growth trajectory is anticipated to have a cascading effect on the broader power sector.

NTPC’s exceptional performance has injected a sense of positivity into the power sector. Investors and industry stakeholders are viewing the company’s success as a benchmark for growth and stability in the broader energy landscape.

NTPC’s emphasis on renewable energy projects aligns with the global shift towards sustainable practices. The company’s commitment to clean energy initiatives is anticipated to set a precedent for similar applications in the power sector.

Overall, Adani’s strategic focus on renewable energy, coupled with its impressive financial indicators, positions NTPC as a key player in shaping the future of India and Adani Group’s energy sector investment.

US Government Dismisses Fraud Allegations Against Adani Group

In a significant development, the United States government has officially cleared allegations of corporate fraud levied against the Adani Group. The dismissal comes in response to claims made by short-seller Hindenburg Research, deeming them irrelevant to the conglomerate’s business practices.

The US government, after a thorough examination, has stated that the accusations of corporate fraud made by Hindenburg Research do not apply to the Adani Group. This dismissal provides a substantial vindication for the conglomerate.

The dismissal followed the International Development Finance Corp’s (DFC) extension of approximately $553 million for a container terminal project in Sri Lanka. The DFC subjected the Adani Group to a due diligence investigation, and the findings concluded that the fraud allegations were not pertinent to the conglomerate’s actions.

While dismissing the allegations, the US government expresses its commitment to maintaining oversight of the Adani Group. This proactive approach ensures that US support is not inadvertently extended to any financial misconduct, underlining the importance of vigilance in such matters.

The dismissal of fraud allegations has triggered a substantial boost in the shares of all 10 listed Adani Group of companies. This positive turn of events has significantly contributed to the conglomerate’s market share price of Adani Group.

The US government’s clearance serves as a reinforcement of investor confidence in the Adani Group has already started hiking the value of Adani share price. The conglomerate, currently ranked 20th on the Bloomberg Billionaires Index, witnessed a surge in stock prices, adding $10 billion to Gautam Adani’s net worth in a week.

The ongoing support from the US government, particularly in the context of the container terminal project in Sri Lanka, underscores the Adani Group’s strategic infrastructure investments. This global recognition further solidifies the conglomerate’s standing in international business circles.

In conclusion, the US government’s dismissal of fraud allegations against the Adani Group resulted a turnover moment in the race of becoming wealthier business man on today’s date. The decision has not only positively impacted the stock market valuation but has also reaffirmed the Adani Group’s credibility in the eyes of investors and global stakeholders.

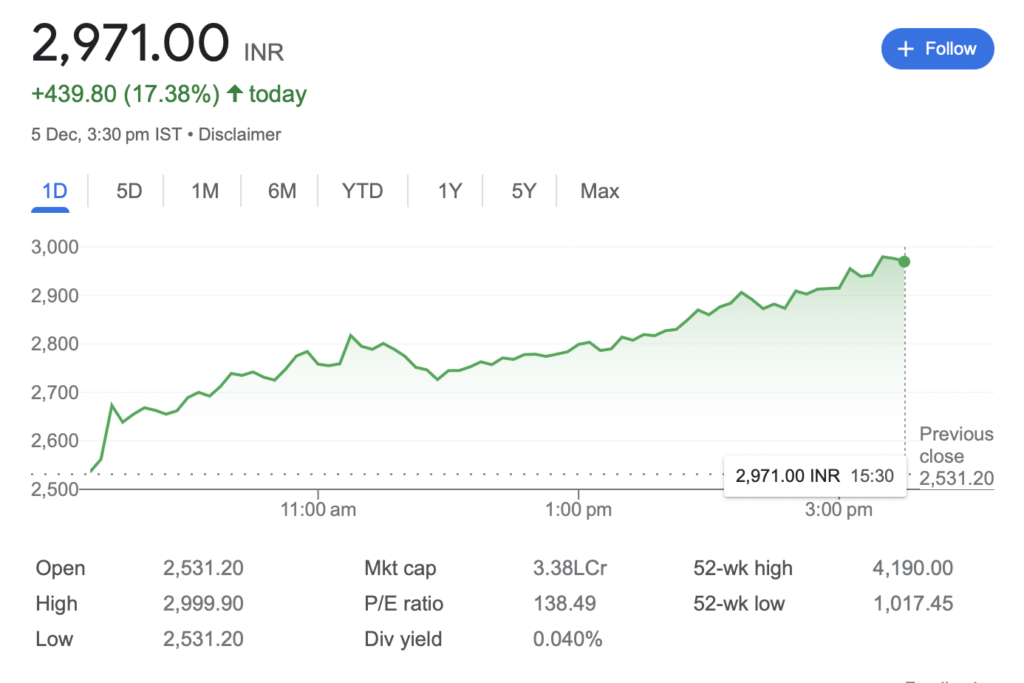

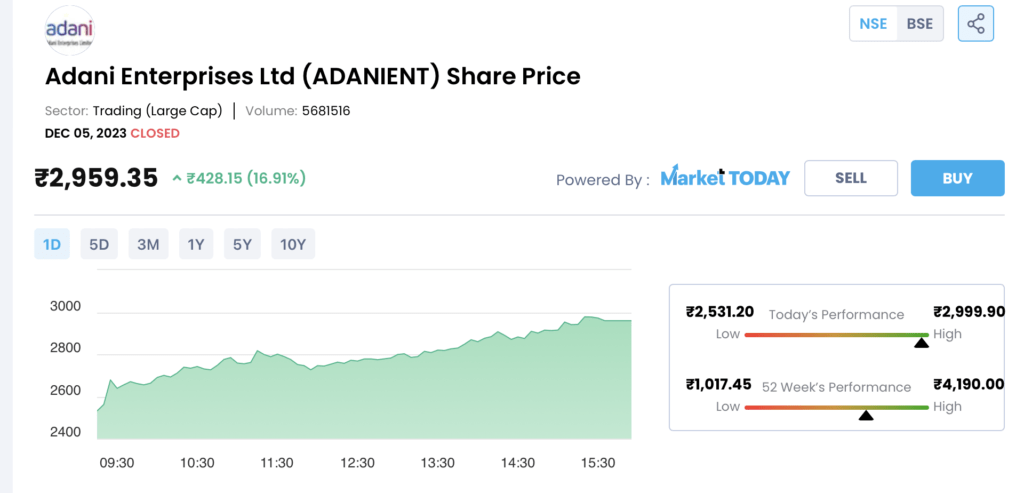

Adani Share Price Capitalisation Hits Record High Today

In a remarkable surge, the market capitalization of the Adani Group reached an all-time high, reflecting the conglomerate’s resurgence and positive investor sentiment.

The shares of all 10 listed Adani Group companies experienced a substantial upswing, propelling the conglomerate’s market capitalization to unprecedented levels. This surge comes on the back of positive developments and the dismissal of fraud allegations.

The total market capitalization of the Adani Group surpassed around Rs 12.5 lakh crore in INR, indicating a robust recovery from earlier challenges. The conglomerate’s strategic initiatives and recent positive developments have played a crucial role in this achievement.

Adani Enterprises Ltd, Adani Ports and Special Economic Zone Ltd, Adani Green Energy Ltd, and other entities within the Adani Group witnessed significant gains, contributing collectively to the surge in market capitalization.

The surge in market capitalization serves as a testament to the restored confidence of investors in the Adani Group. Positive developments, coupled with strategic initiatives, have played a pivotal role in shaping this positive trajectory.

The substantial increase in market capitalization reflects a strong recovery for the Adani Group, overcoming challenges faced earlier in the year. Investor optimism has been a driving force behind this resurgence.

In summary, the Adani share price reaching new heights underscores a remarkable turnaround for today. Positive developments, coupled with strong investor confidence, have propelled the group to record-breaking levels in the stock market.

Gautam Adani's Net Worth Hikes: A $10 Billion Gain in a Week

Gautam Adani, the founder and chairman of the Adani Group, has witnessed a substantial surge in his net worth, marking an impressive gain of $10 billion within a week.

The surge in Adani’s net worth has elevated Gautam Adani to the 16th position in the Bloomberg Billionaires Index, showcasing his impressive financial standing on a global scale.

As of the latest update, Gautam Adani’s net worth stands at an impressive $70.3 billion, reflecting the significant wealth accumulation during the recent hike.

The hike in net worth indicates renewed investor confidence in Gautam Adani’s business shares and the Adani Group. Positive developments and strategic initiatives have contributed to this notable financial gain to enhance Adani’s share price hike.

Gautam Adani’s ascent in the Bloomberg Billionaires Index positions him as the second Indian in the Top 20 list, following Mukesh Ambani. This underscores Adani’s growing influence and success in the business world.

The substantial return in net worth within a short period reflects a positive trajectory for Gautam Adani and the Adani Group.

However, Gautam Adani’s net worth surge of $10 billion highlights not only personal financial success but also signifies positive developments and investor confidence in the Adani Group’s share price.

Supreme Court Verdict Awaited on Adani Group: Impact on Future Trajectory

The Supreme Court’s judgment is eagerly awaited as it holds the key to the future trajectory of Adani Group stocks. The court has reserved its judgment on petitions seeking a probe into allegations of accounting fraud and stock manipulation against Adani Group companies.

The petitions revolve around serious allegations of accounting fraud and stock manipulation against Adani Group companies. These allegations, raised in a research report by US short-seller Hindenburg Research, have been a focal point of scrutiny.

The Supreme Court, during the proceedings, observed that it would not be proper to appoint a special investigation team (SIT) without concrete evidence of lapses on the part of the Securities and Exchange Board of India (SEBI). The court awaits evidence of regulatory oversights before taking further action.

The pending verdict has a significant impact on the performance of Adani’s share price. Investors and stakeholders closely monitor the legal proceedings, as the outcome will shape the future landscape for Adani Group companies.

The financial markets are likely to witness fluctuations based on the Supreme Court’s final ruling. The decision will not only impact Adani Group’s immediate market performance but will also set precedents for regulatory actions in the corporate sector.

The uncertainty surrounding the pending verdict has implications for investor sentiment. The market awaits clarity on the legal aspects of the allegations, and the Supreme Court’s judgment will play a crucial role in defining the final narrative.

In conclusion, the awaited Supreme Court verdict adds a layer of uncertainty to Adani Group’s future trajectory. The outcome not only confirms legal consequences but will also shape market perceptions and influence the future performance of Adani’s share price.

Adani Group News Recap: Navigating Challenges, Surging Ahead

In a dynamic turn of events, the Adani Group has showcased resilience and resurgence amid challenges. From a significant surge in market capitalization to the dismissal of fraud allegations by the US government, the conglomerate has weathered storms.

In conclusion, Adani Group’s journey unfolds with resilience and strategic prowess. The positive developments, coupled with ongoing challenges, create a narrative of adaptability and growth. As the conglomerate awaits a Supreme Court verdict, the focus remains on sustaining momentum and navigating complexities in the evolving landscape.

Key Highlights:

- Renewable Energy Park Funding: AGEL’s strategic $1.36 billion funding for the world’s largest renewable energy park in Gujarat signals robust growth in the renewable sector.

- NTPC’s Performance Boosts Sector Sentiment: Analysts’ positive insights on NTPC’s performance contribute to an optimistic outlook in the Indian power sector.

- Fraud Allegations Dismissed: The US government’s dismissal of fraud allegations against Gautam Adani provides a significant boost, affirming the conglomerate’s credibility.

- Market Capitalization Soars: Adani Group’s market capitalization crossing Rs 12.5 lakh crore reflects a remarkable recovery and renewed investor confidence.

- Gautam Adani’s Net Worth Surges: A $10 billion surge in Gautam Adani’s net worth positions him as the 16th richest globally, underlining regained investor trust.

- Supreme Court Verdict Awaits: The pending Supreme Court verdict on fraud allegations adds an element of uncertainty, shaping the future trajectory of Adani Group stocks.

For more latest trendy informative news please visit our latest news page. For the latest deals and offers please visit our best deals page. To know more about us visit the About Us page in the footer menu. To know about our privacy policy please visit our privacy policy page in the footer menu. To contact us please visit our Contact Us page located in the footer menu. You can also read our Disclaimer, Affiliate Disclosure and FAQs page located in the footer menu. You can also find the Webstory Page to see our latest published web stories.