Table of Contents

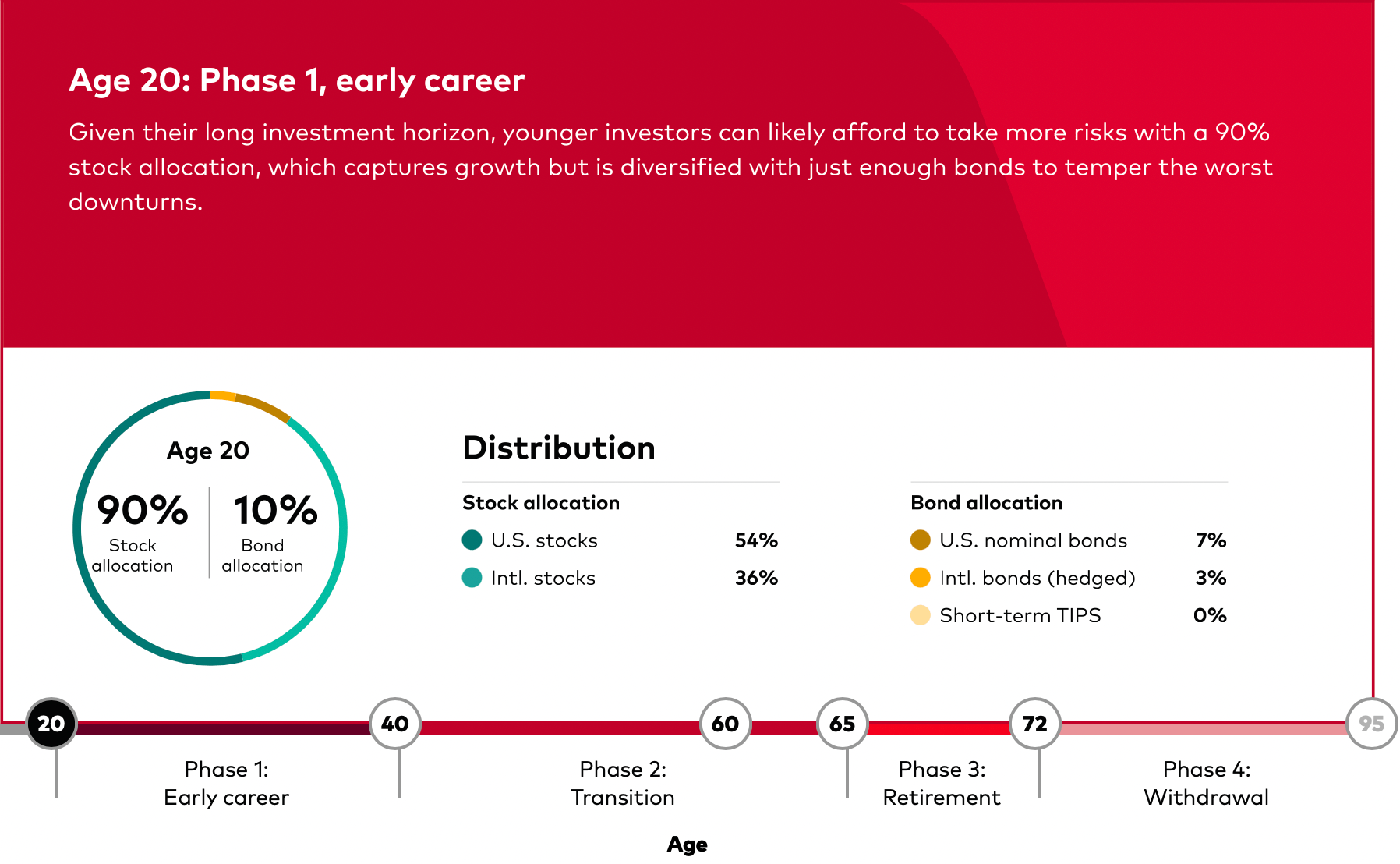

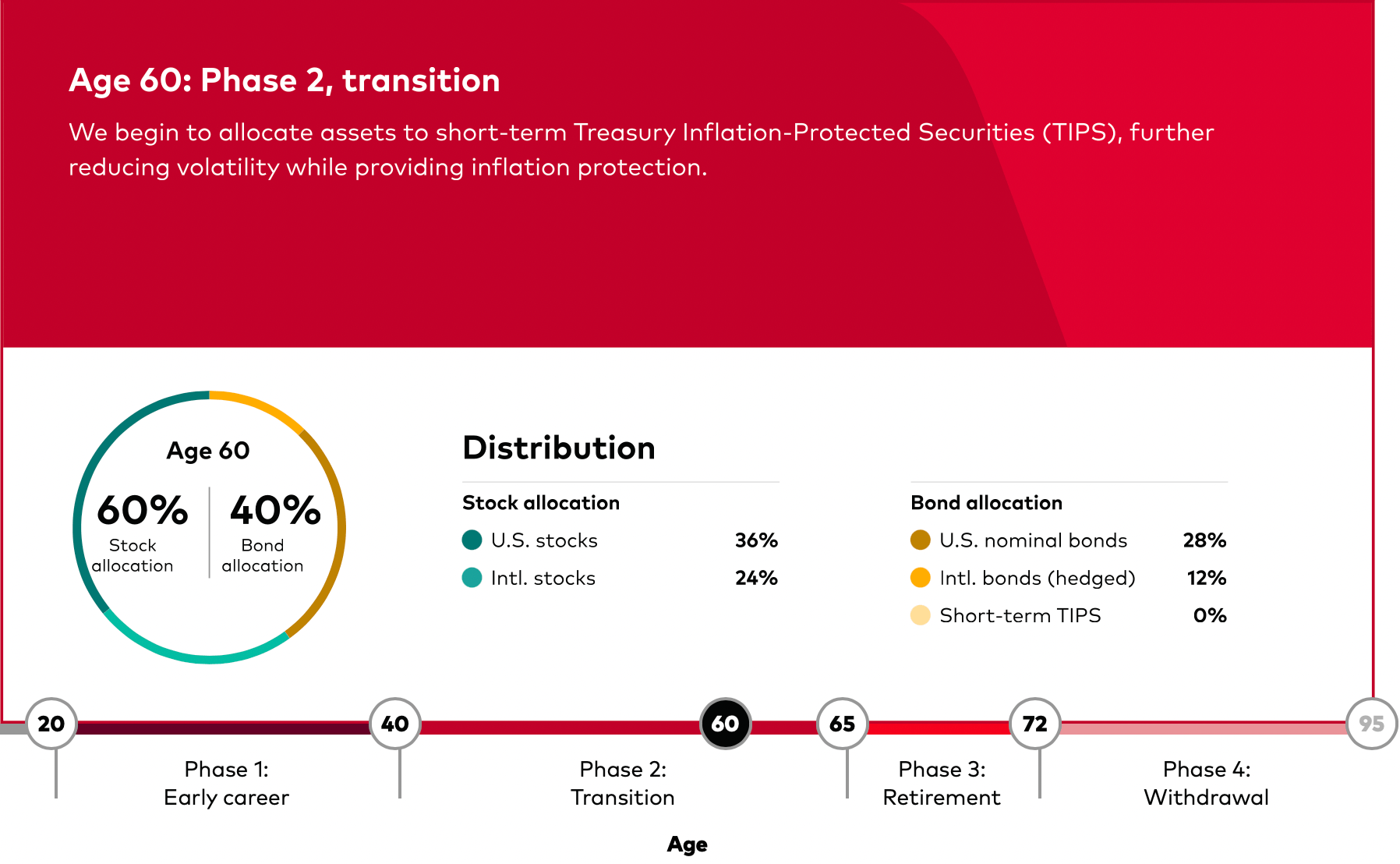

In the world of finance, reaching the $1 million mark is a significant achievement. It has become a benchmark for retirement plans, and with the right strategy, it might be more attainable than you think. Embark on a transformative journey by exploring the art and science of “Investing in Vanguard.” Navigate the nuances of wealth-building, uncover the power of compounding, and unveil tax-saving strategies that can reshape your financial future.

The S&P 500 and Why It Matters

The S&P 500, tracking the 500 largest U.S. companies, is a smart choice for investors throughout the globe. Learn why it serves as a benchmark and a diversified investment option.

Historical Performance

Historical performance says that the S&P 500, has averaged around 10% annual returns since 1957. The reason why the Vanguard S&P 500 ETF is a preferred choice for its impressive 13% average annual returns since 2010.

Invest wisely, and let Vanguard pave your way to financial success!

How Compounding Interest Works

In the world of finance, compounding is like a hidden force that works tirelessly to grow your wealth over time. It’s not just a concept; it’s a powerful mechanism that can turn small, regular investments into substantial sums. So, let’s unravel the mystery of compounding and explore why it’s a game-changer in the realm of investing.

At its core, compounding involves earning returns not only on your initial investment but also on the returns you’ve received previously. Picture it as a snowball rolling down a hill, steadily gaining size as it picks up more snow. In the world of finance, your money works similarly, accumulating momentum and multiplying itself as time goes by.

Here's how it works in action:

Earning Returns on Your Original Investment:

Let’s say you invest $1,000 in a stock, and it generates a 10% return in the first year. Now, you not only have your initial $1,000 but an additional $100 in returns, bringing your total to $1,100.Earning Returns on Previous Returns:

In the second year, if the same 10% return holds, you’re not just earning $100 on your initial investment; you’re earning $110 on the total amount of $1,100. Now, your investment has grown to $1,210.Rinse and Repeat:

As time goes on, this process continues to snowball. The returns you earn in each period contribute to a larger base, and the cycle repeats. The longer you let this process unfold, the more significant the impact.

Visualising the Power of Compounding Interest

To illustrate the point, let’s consider a scenario where you invest $500 monthly with an average annual return of 10%. After 20 years, your total investment would be $120,000, but the total value of your investment would be a staggering $343,600. The magic lies in the compounding effect on both your contributions and the returns generated.

Why Time Matters in Compounding Interest

Time is the unsung hero of compounding. The longer your money has to grow, the more impactful the compounding effect becomes. It’s like planting a seed and watching it grow into a mighty tree over the years – the longer it has to root and flourish, the more impressive the results.

In conclusion, compounding is not just a financial concept; it’s a force that can work in your favor when it comes to building wealth through investments. By harnessing the power of returns on both your original investment and the returns generated, you can set in motion a financial snowball that grows larger and more powerful with each passing year. So, embrace the magic of compounding, start early, and let time be your ally on the journey to financial success.

Tax-Saving Strategy: Roth IRA and Vanguard S&P 500 ETF

When it comes to smart investing, it’s not just about maximizing returns; it’s also about optimizing your tax strategy. A powerful combination for tax-savvy investors is the Roth IRA paired with the Vanguard S&P 500 ETF.

Roth IRA: A Brief Overview

A Roth IRA is a retirement account that operates on a unique tax principle. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars. The beauty lies in the withdrawals during retirement – they are tax-free. This means your investment gains can grow without being eroded by future tax liabilities.

Vanguard S&P 500 ETF: A Solid Investment Choice

The Vanguard S&P 500 ETF adds another layer of advantage. By investing in this Exchange-Traded Fund (ETF), you gain exposure to the 500 largest U.S. companies, tracking the S&P 500 index. With its historically consistent returns and low expense ratio of 0.03%, it’s a cost-effective and reliable choice for long-term investors.

How Investing in Vanguard Work?

Investing in the Vanguard S&P 500 ETF within a Roth IRA creates a powerful synergy. As your investments grow, you won’t be subject to capital gains taxes when you eventually withdraw the funds in retirement. This tax-free status can translate to substantial savings over the long term, leaving you with more money in your pocket.

Tax Savings in Action for positive investing in Vanguard

Consider this: as your investment in the Vanguard S&P 500 ETF generates capital gains, a traditional brokerage account could incur capital gains taxes. However, within a Roth IRA, those gains remain untouched by taxes, allowing your wealth to compound more efficiently.

In essence, the Roth IRA and Vanguard S&P 500 ETF combo provides a strategic approach to not only grow your wealth but also keep a significant portion of it shielded from future tax obligations. It’s a long-term play that aligns with both the goals of building a substantial retirement fund and optimizing your tax efficiency. As with any investment strategy, consulting with a financial advisor is recommended to ensure it aligns with your individual financial goals and circumstances.

The Vanguard ETF Trio for Wealth Building

Vanguard, a renowned name in the investment world, offers a trio of Exchange-Traded Funds (ETFs) that stand out as wealth-building powerhouses. Let’s take a brief look at these three Vanguard ETFs:

In essence, the Roth IRA and Vanguard S&P 500 ETF combo provides a strategic approach to not only grow your wealth but also keep a significant portion of it shielded from future tax obligations. It’s a long-term play that aligns with both the goals of building a substantial retirement fund and optimizing your tax efficiency. As with any investment strategy, consulting with a financial advisor is recommended to ensure it aligns with your individual financial goals and circumstances.

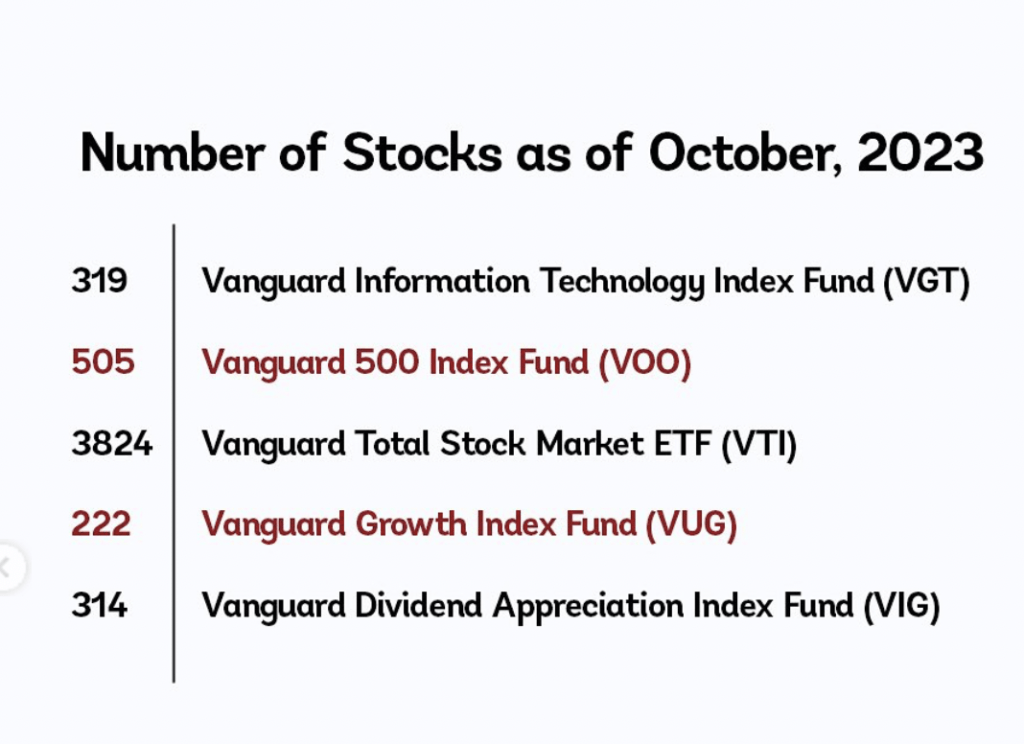

Vanguard 500 Index Fund (VOO -0.50%)

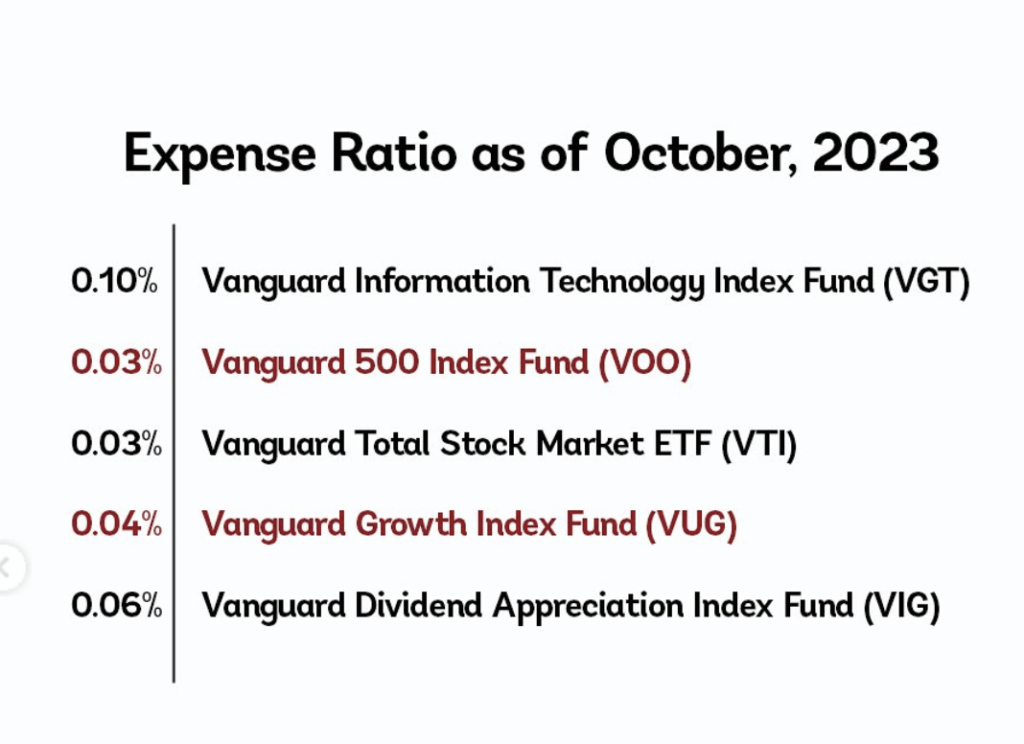

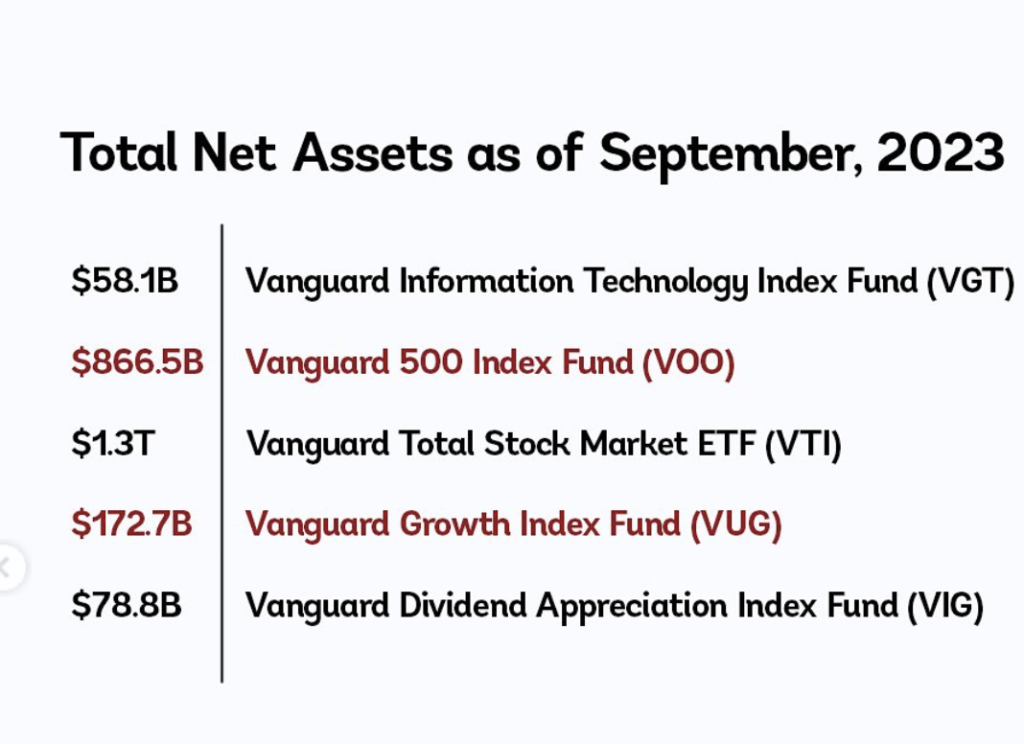

Highlights: Mirrors the performance of the S&P 500 with an impressively low expense ratio of 0.03%. Over the past decade, it has generated total returns exceeding 200%, making it a reliable choice for those seeking consistency in line with the S&P 500.

Vanguard Growth Index Fund (VUG -0.93%)

Highlights: Geared towards market-beating growth, VUG focuses on large-cap growth companies known for innovation. With a minimal expense ratio of 0.04%, it has delivered remarkable total returns of 635% over nearly 20 years, outperforming the S&P 500.

Vanguard Information Technology Index Fund (VGT -1.02%)

Highlights: For those interested in cutting-edge technologies like artificial intelligence, VGT is a strategic choice. Despite a slightly higher expense ratio of 0.10%, it has produced market-crushing total returns of 979% since its inception in 2004.

This Vanguard ETF trio covers a spectrum of investment goals, from mirroring the broader market to focusing on growth and technology. With low expense ratios and a history of robust performance, these funds present investors with diversified and cost-effective options for building long-term wealth. As with any investment decision, it’s advisable to conduct thorough research and consider individual financial goals before making choices.

Expert Insights: Should You Invest $1,000 in Vanguard S&P 500 ETF?

Before jumping into any investment, it’s prudent to consider expert opinions. The Motley Fool Stock Advisor analyst team, known for its savvy market insights, provides valuable perspectives on the Vanguard S&P 500 ETF.

In a recent assessment, the analysts identified what they believe are the top 10 stocks for investors to buy now. Interestingly, the Vanguard S&P 500 ETF didn’t cut. This doesn’t necessarily reflect negatively on the ETF but suggests there might be alternative stocks with the potential for significant returns in the coming years.

The Motley Fool’s Stock Advisor service offers a blueprint for success, providing guidance on portfolio building, regular analyst updates, and two new stock picks each month. Notably, the service has outperformed the S&P 500 by more than triple since 2002.

So, should you invest $1,000 in the Vanguard S&P 500 ETF? While it remains a solid choice for many investors seeking exposure to the broader market, considering alternative stock picks recommended by experts could potentially lead to even more substantial returns. As with any investment decision, diversification and staying informed are key factors in making choices aligned with your financial goals.

Conclusion: The Road to Financial Success

In the journey toward financial success, the path is often shaped by strategic decisions and informed choices. As we navigate the realm of investments, particularly focusing on the Vanguard S&P 500 ETF and related strategies, several key takeaways emerge.

Consistency and Power of Vanguard S&P 500 ETF:

The Vanguard S&P 500 ETF proves to be a stalwart companion for investors seeking consistency and reliability. Its historical performance, mirroring the S&P 500 with an average annual return of over 13%, underscores its potential to pave the way toward financial milestones.

Harnessing the Magic of Compounding:

The concept of compounding acts as a catalyst in the wealth-building process. As illustrated, reinvesting returns over time can exponentially grow your investments, emphasizing the significance of time as a critical factor in the equation.

Tax-Saving Strategies with Roth IRA:

Integrating the Roth IRA into your investment strategy introduces a tax-saving dimension. By utilizing the tax advantages of a Roth IRA, especially when paired with the Vanguard S&P 500 ETF, investors can potentially save thousands in taxes, allowing for more efficient wealth accumulation.

The Vanguard ETF Trio for Diversified Wealth:

Vanguard’s trio of ETFs presents investors with a diversified toolkit. Whether mirroring the S&P 500, chasing market-beating growth, or delving into cutting-edge technologies, these funds offer cost-effective options for building wealth over the long term.

Expert Perspectives and Alternative Choices:

Considering expert insights, particularly from the Motley Fool Stock Advisor analysts, adds a layer of informed decision-making. While the Vanguard S&P 500 ETF remains a robust choice, exploring alternative stock picks recommended by experts could open new avenues for returns.

In conclusion, the road to financial success is multifaceted. It involves a blend of consistent, reliable investments, strategic tax planning, and staying attuned to expert opinions. The Vanguard S&P 500 ETF, coupled with prudent financial strategies, can be a formidable driver on this journey. Remember, financial success is not a destination but a continuous process of informed choices and adaptive strategies. For more latest recent news please visit our latest news page. For checking the Vanguard stock report today visit the link.

For various needy offers and deals of the day you can check out our Best Deals page. To know more about us visit the About Us page in the footer menu. To know about our privacy policy please visit our privacy policy page in the footer menu. To contact us please visit our Contact Us page located in the footer menu. You can also read our Disclaimer, Affiliate Disclosure and FAQs page located in the footer menu. You can also find the Webstory Page to see our latest published web stories.