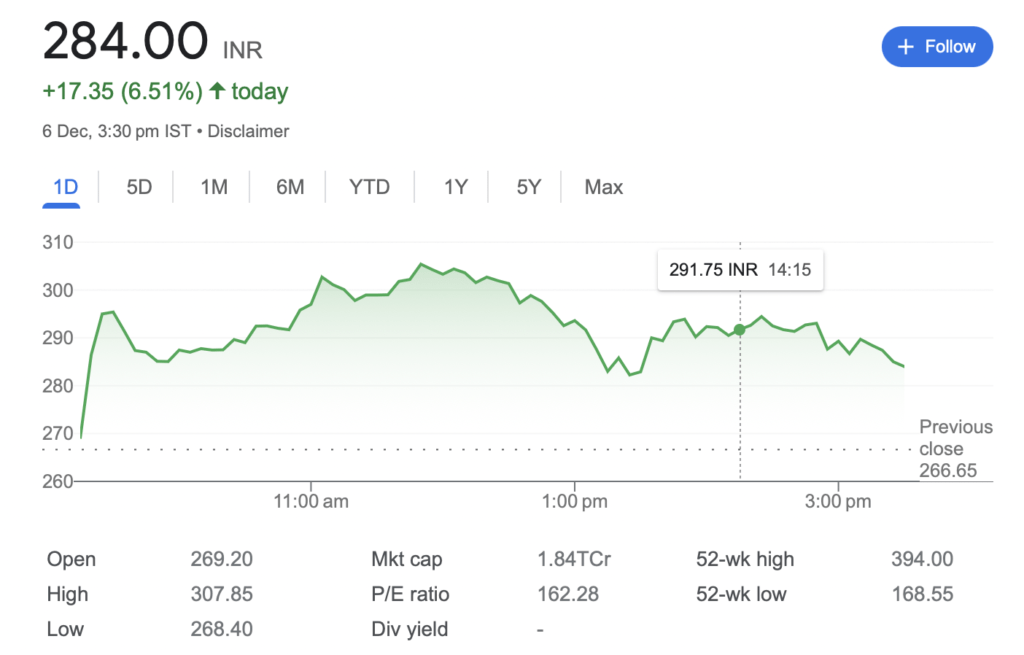

In a surprising turn of events, NDTV Ltd has witnessed a remarkable surge in NDTV stock prices, with a 36.18% gain in just two days. As of the latest available data on 6th December 2023, promoters hold a substantial hike of the stock price of 284 INR in the company. The 14-day relative strength index (RSI) for the stock is at a high of 85.22, indicating potential overbought conditions. Let’s delve into the details behind this unexpected rally and the factors contributing to NDTV’s stock momentum.

Understanding the Stock Hike Reason

Unprecedented NDTV Stock Price Movement

NDTV’s stock surged by an impressive 15.01% in a single trading session, reaching a day high of Rs 284, significantly surpassing its previous close at Rs 269. This substantial increase accounts for a remarkable hike gain over two days.

Trading Volume and Market Capitalisation of NDTV

The surge in NDTV’s stock was accompanied by heavy trading volumes, with approximately 9.18 lakh shares changing hands on BSE alone. The turnover on the counter reached Rs 26.80 crore, contributing to a market capitalization of Rs 1,887.40 crore. The trading activity far exceeded the two-week average volume of 2.71 lakh shares, indicating heightened investor interest.

Year-to-Date Performance of NDTV stock

While the recent surge is noteworthy, it’s essential to highlight that NDTV’s stock has experienced a slip of over 14% on a year-to-date basis. Examining the performance over a more extended period provides a holistic perspective on the stock’s journey.

Factors Influencing NDTV's Stock Rally

Regulatory Attention and Clarification of NDTV

Both BSE and NSE sought clarification from NDTV regarding the sudden increase in share prices. In response, NDTV stated that it is unaware of any specific reason for the surge and emphasized its commitment to promptly informing stock exchanges of all necessary information. The assurance of transparency is crucial in maintaining investor confidence.

Technical Indicators and Moving Averages of NDTV Stock

The stock’s trading position above the 5-day, 10-, 20-, 30-, 50-, 100-, 150-, and 200-day simple moving averages (SMAs) signals a robust bullish trend. The 14-day RSI at 85.22 suggests overbought conditions, indicating potential profit-taking in the near future.

Global Developments and Adani Group Connection with NDTV

NDTV’s surge coincided with gains in all listed Adani Group stocks. This followed the dismissal of short-seller Hindenburg Research’s allegations of corporate fraud against Indian billionaire Gautam Adani by the US government. The positive sentiment surrounding the Adani Group contributed to NDTV’s upward momentum.

Global Developments and Adani Group Connection with NDTV

NDTV’s stock is currently trading at a price-to-equity (P/E) ratio of 199.36 and a price-to-book (P/B) value of 4.60. These metrics indicate a relatively high valuation, reflecting market optimism. Investors should consider these figures in the context of the company’s growth prospects and industry benchmarks.

Beta and Volatility factor of NDTV

With a one-year beta of 0.9, NDTV’s stock exhibits low volatility compared to the market. This suggests a more stable investment, but investors should remain vigilant, considering the recent surge and potential profit-taking.

The Adani Influence and Future Outlook of NDTV

NDTV’s stock surge aligns with positive developments for the Adani Group, further emphasizing the interconnected nature of the stock market. While the recent gains are substantial, investors should assess the long-term sustainability of this momentum, considering both global and company-specific factors.

In conclusion, NDTV’s recent stock hike is a confluence of technical indicators, market sentiment, and external developments. As investors navigate the evolving landscape, staying informed about the company’s response to regulatory queries and monitoring global market trends is essential.

In the ever-fluctuating landscape of the stock market, NDTV’s recent hike, intertwined with the Adani Group’s positive developments, has stirred a range of emotions among investors. The sudden 36.18% gain in just two days brought forth a hope of excitement, as traders celebrated the rapid increase in stock value. The adrenaline of witnessing NDTV’s stock reaching a day high of Rs 306.55 (Today 6th December 2023, Rs. 284 till 3.30 a.m.) surpassing expectations, resonated with the thrill of a financial rollercoaster.

However, with this exhilaration came a tinge of caution. The 14% slip on a year-to-date basis injected a note of sobriety into the euphoria, prompting investors to reflect on the sustainability of this upward trajectory. The regulatory scrutiny and subsequent clarification from NDTV added an element of uncertainty, sparking a mix of curiosity and concern among market participants.

Yet, amidst these fluctuations, the global exoneration of Gautam Adani and the Adani Group infused a sense of relief and optimism. The dismissal of allegations by short-seller Hindenburg Research resonated as a triumph, transforming scepticism into confidence. Investors, once hesitant, now navigated the market with renewed faith, recognizing the interconnected dance of global events on individual stock performance.

In conclusion, the recent Adani effect on NDTV’s stock has been nothing short of a financial symphony, playing different notes of excitement, caution, curiosity, concern, relief, and optimism. As investors continue to ride this emotional wave, the future trajectory of NDTV’s stock will be shaped not just by technical indicators but by the collective sentiments of those watching the market more clearly.

For more latest trendy news like this visit our Latest News page. For various needy offers and deals of the day you can check out our Best Deals page. To know more about us visit the About Us page in the footer menu. To contact us please visit our Contact Us page located in the footer menu. You can also read our Disclaimer, Affiliate Disclosure and FAQs page located in the footer menu. You can also find the Webstory Page to see our latest published web stories.