In the relentless world of financial markets, where every move counts, being equipped with real-time and insightful information is paramount. At Live Aap Tak News, we recognize the urgency of staying ahead, and in this comprehensive article, we provide you with a deep dive into recent market developments, focusing on the Sensex, Nifty 50, and their intricate dynamics. For more relative news visit our latest news page.

Market Highlights: Sensex and Nifty 50 Performance

Snapback After Two-Day High

Recent market movements have seen a shift in the upward trajectory, with both the Sensex and Nifty 50 snapping a two-day winning streak. The Sensex closed at 69,551.03, down 377.50 points, while the Nifty settled 0.46% lower at 20,901. The day began on a positive note, tracking global cues, but caution prevailed as investors awaited crucial CPI and IIP data.

Sectoral Impact

The downturn was notably felt in sectors like banking and realty, dragging down the benchmark indices. Ultratech and Axis Bank emerged as major gainers, counterbalancing the losses. The midcap and small-cap segments, reflective of broader market sentiments, also faced pressure in alignment with benchmark indices.

Global Market Indicators

Anticipation in Global Markets

While India experienced this market correction, global markets exhibited mixed signals. Asian stock markets displayed an uptick in anticipation of key economic data from the U.S. and upcoming central bank meetings. The MSCI All-World index, currently at four-month highs, saw a modest increase of 0.2%. In Europe, the STOXX 600 maintained an upward trajectory, and U.S. futures indices showed gains in the range of 0.1-0.2%.

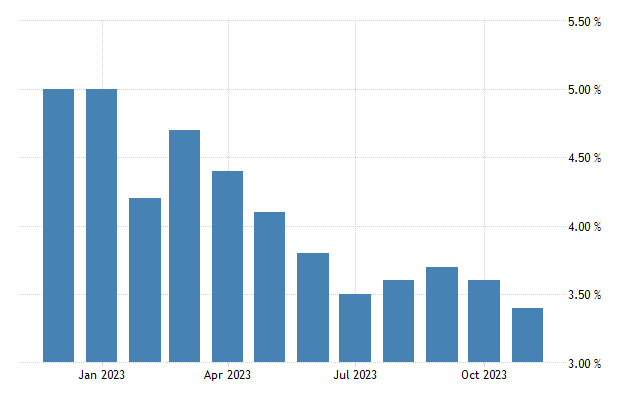

Factors Influencing Global Trends

Investors worldwide eagerly await insights from major central banks, hinting at potential rate cuts in the coming year. This week’s focus is primarily on U.S. consumer and wholesale inflation, as well as the Federal Reserve’s latest stance on interest rates. This global context significantly influences India’s markets, amplifying the importance of staying abreast of international developments

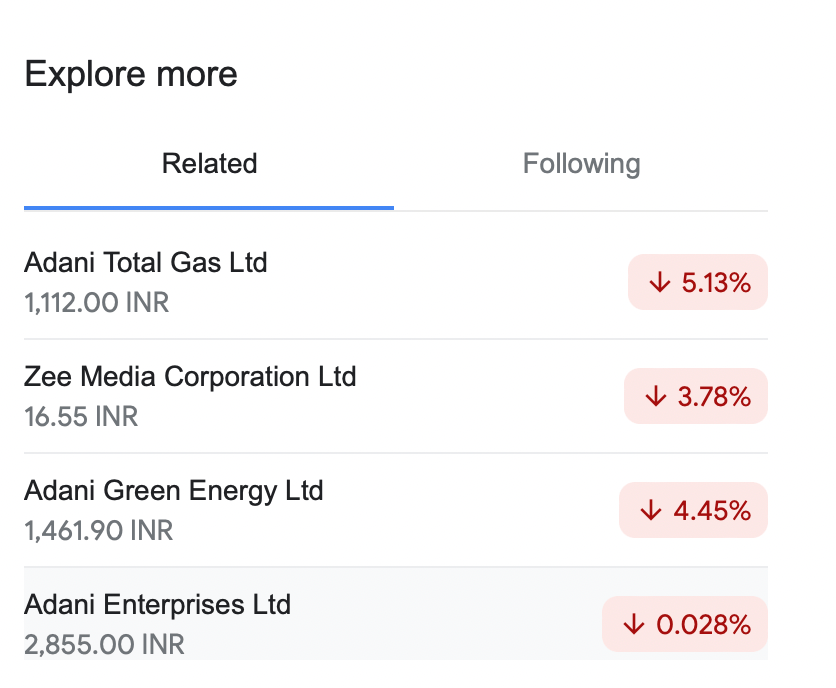

Adani Effect: NDTV and Adani Shares Roller Coaster

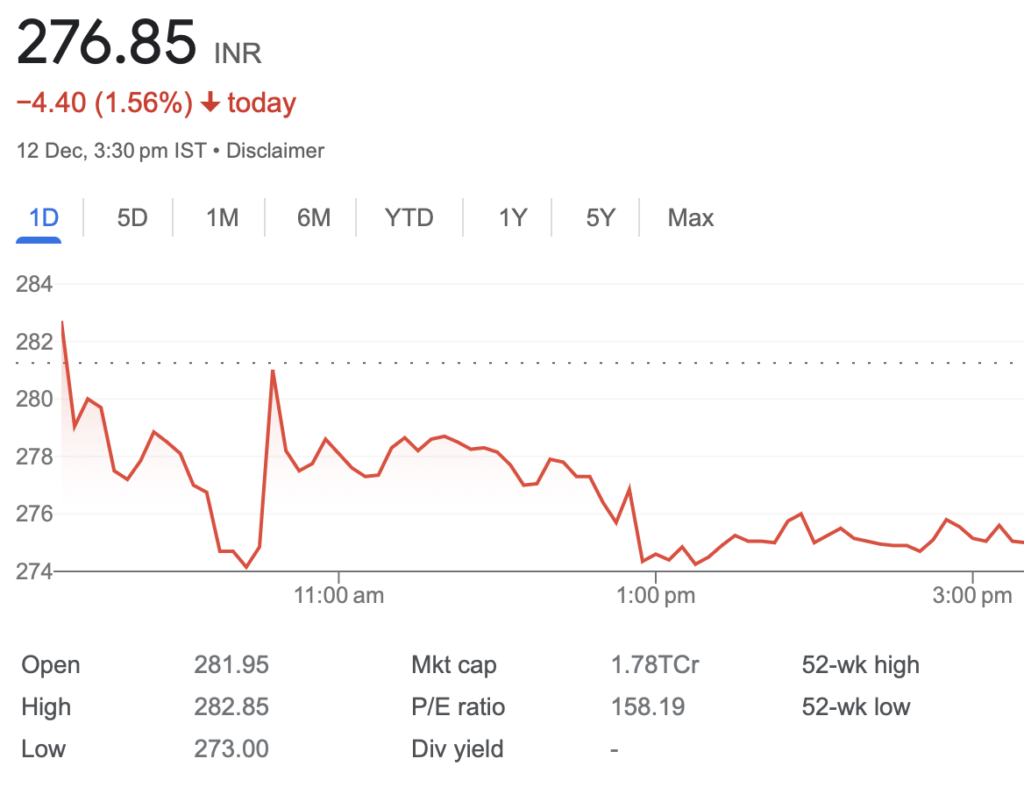

Last Week's Hike and Today's Downturn

Last week witnessed a significant hike in NDTV shares, propelled by what is colloquially known as the “Adani Effect.” However, the euphoria seems short-lived as NDTV and Adani shares experienced a downturn today. This unpredictability underscores the need for agility and real-time value insights in navigating the stock market. NDTV today share price has gone down a bit from 276.85 to 281 from the last report.

Spotlight on Specific Stocks and Sectors

Corporate Moves and Sectoral Developments

The corporate landscape remains dynamic, with companies like Adani Ports planning to raise $600 million through non-convertible debentures and SpiceJet approving a fundraising of ₹2,250 crore through share and warrant issuance. Additionally, Thermax secured a ₹500 crore order to establish bio-CNG plants, showcasing the diversity of market activities.

Gold Prices, Pharma Bids, and IT Sector Reshuffling

As the market adjusts, various sectors experience notable movements. Gold prices saw an uptick as the dollar softened, while pharma giant Sun Pharma increased its bid for the outstanding shares of its U.S. subsidiary, Taro Pharma. On the IT front, Infosys witnessed a decline as the CFO resigned in a surprise move.

Gold prices see an uptick as the dollar retreats, reaching $1,985.49 per ounce, with investors closely watching U.S. inflation data and central bank meetings for future trends.

Market Buzz: Stocks Making Waves on December 12, 2023

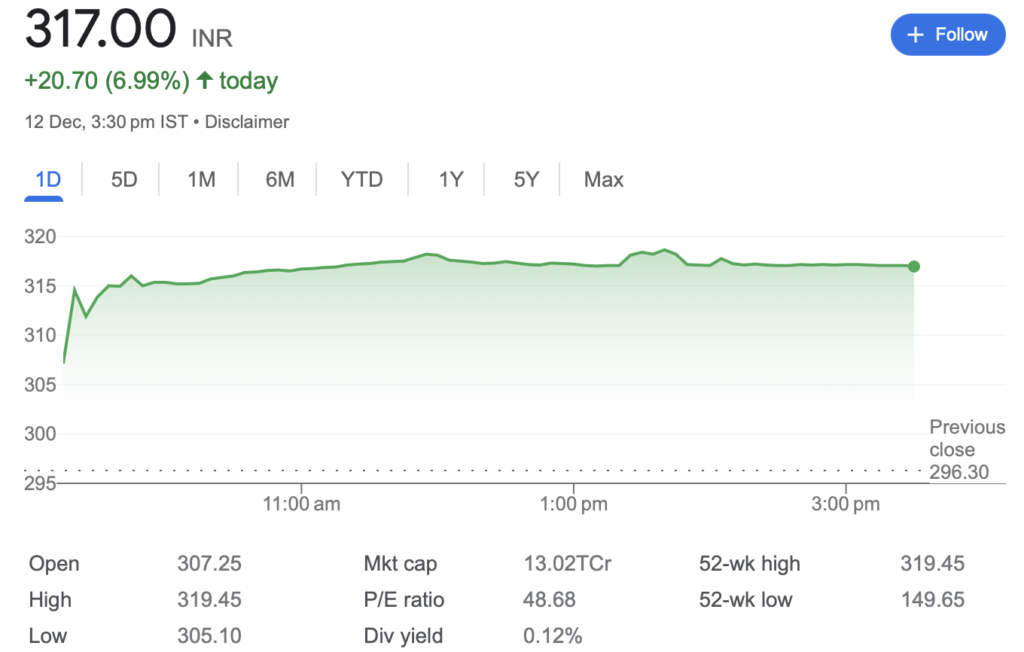

BLS International Services (BLS)

BLS International Services is soaring high, hitting a 52-week high following a significant contract win. The company has secured a contract to manage consular, passport, and visa services for the High Commission of India in Canada. This includes overseeing services not only in Ottawa but also at the Consulate Generals of India in Toronto and Vancouver.

- Current Stock Price: ₹317.00 (+20.65%)

- Day High: ₹319.50

- Day Low: ₹305.00

- Volume (BSE): 15,29,107.00

This impressive hike reflects the market’s positive response to the strategic contract acquisition, underlining BLS International Services’ growing influence in the sector.

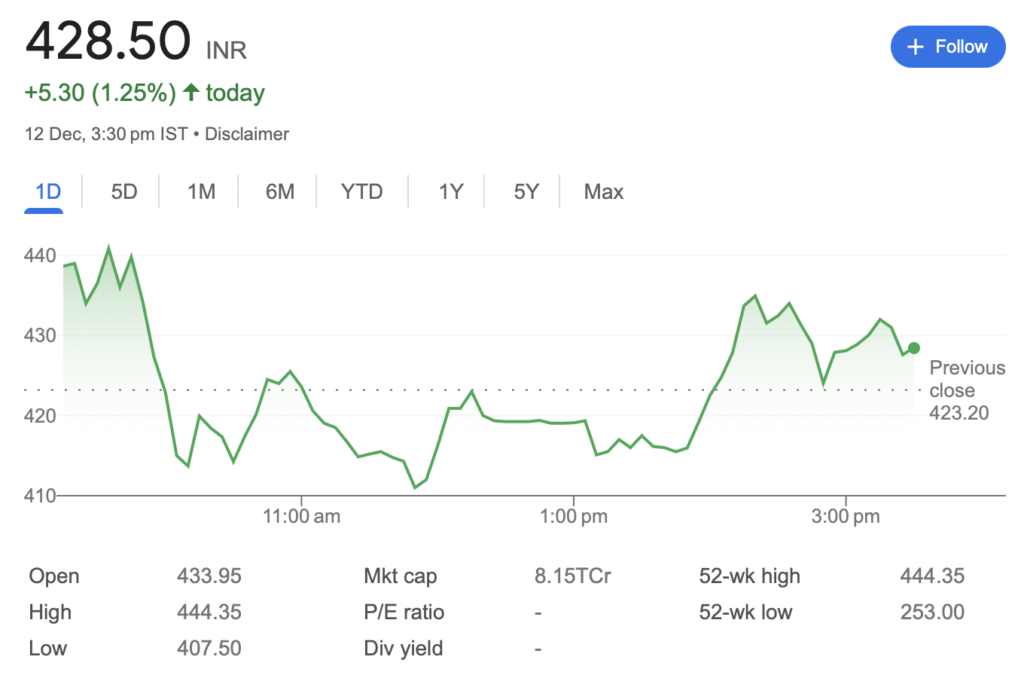

Sterling & Wilson Renewable Energy

Sterling & Wilson Renewable Energy has caught the market’s attention by hitting the 5% upper circuit after announcing the launch of a Qualified Institutional Placement (QIP) issue. The company’s Securities Issuance Committee has set the floor price for the QIP at ₹365.02 per share.

- Current Stock Price: ₹429.05 (+6.30%)

- Day High: ₹443.85

- Day Low: ₹405.00

- Volume (BSE): 4,51,773.00

Investors seem to be responding positively to the strategic move of the QIP, showcasing confidence in Sterling & Wilson Renewable Energy’s future stock shares.

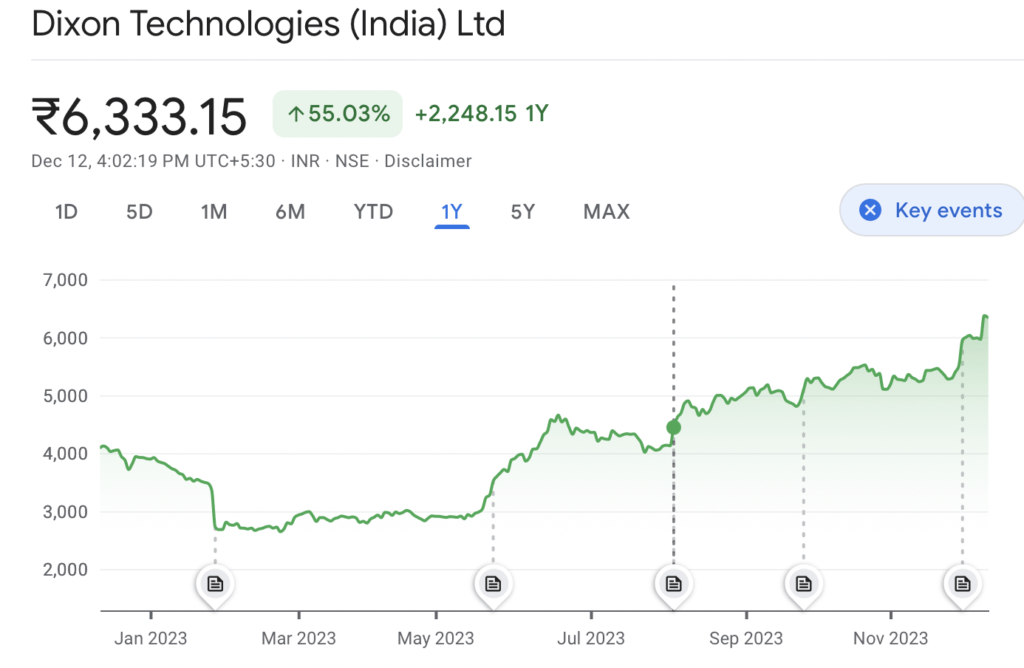

Dixon Technologies (India)

Dixon Technologies, a prominent electronics manufacturing company, has witnessed a 5% jump. This surge follows the news of its fully-owned subsidiary, Padget Electronics, securing a manufacturing deal with global tech leader Lenovo. The focus is on manufacturing a range of IT hardware, with a particular emphasis on laptops and notebooks.

- Current Stock Price: ₹6,361.70 (-0.16%)

- Day High: ₹6,764.00

- Day Low: ₹6,328.45

- Volume (BSE): 92,469.00

Despite a slight dip in the current stock price, Dixon Technologies remains in the spotlight due to its strategic move into the IT hardware manufacturing sector.

Indian Rupee or INR

Shifting the focus to the currency market, the Indian rupee has shown resilience by rising 1 paisa to 83.36 against the US dollar in early trade. This comes after a slip to 83.40 on Monday, close to its lifetime low of 83.42. The Reserve Bank of India (RBI) reportedly intervened by selling dollars.

Sensex and Nifty Overview

The broader market indices provide a snapshot of the overall market sentiment. At 09:31 AM, the Sensex gained nearly 100 points, reaching 70,004.54. Tata Steel, ITC, and JSW Steel were the top gainers, while L&T, Infosys, and Bharti Airtel lagged the most.

These real-time updates reflect the dynamic nature of the financial markets, where each development plays a crucial role in shaping investor sentiment. As we navigate through the day, these stocks will continue to draw attention, and market participants will closely monitor their trajectories for potential opportunities.

In addition, Adani Ports and Special Economic Zone are set to raise ₹50 billion ($600 million) through non-convertible debentures, showcasing strategic financial manoeuvres amidst market fluctuations. Concurrently, SpiceJet’s board has given the green light to a fundraising initiative, aiming to secure ₹2,250 crores through the issuance of shares and warrants—a strategic move to navigate challenges in the aviation industry.

On another front, Thermax witnessed a 2% surge as one of its subsidiaries secured a lucrative ₹500 crore contract. The contract involves establishing five bio-CNG plants across multiple locations in India, further enhancing Thermax’s position in the green energy sector.

Meanwhile, Tata Motors achieved a significant milestone in November, recording its highest-ever monthly retail sales of around 53,000 units. This remarkable feat was attributed to robust demand for the company’s sports utility vehicles, particularly during the festive period.

Lastly, Sun Pharma has revised its bid to acquire outstanding shares of its U.S. subsidiary, Taro Pharma, offering $43 per share in cash. This move has had a notable impact on Sun Pharma’s stock and underscores the pharmaceutical company’s strategic growth plans.

Stay tuned with Live Aap Tak News for further updates as the market unfolds its next set of moves in this ever-evolving landscape.

Looking Ahead: Key Milestones

As we look ahead, the market’s focus shifts to upcoming events. Retail inflation and factory production data for India, along with U.S. inflation data, are on the immediate horizon. The data releases are expected to influence market trends and provide valuable insights into the future trajectory of interest rates.

Conclusion: Navigating Market Complexities

In the intricate turnover period of market trends, knowledge is power. At Live Aap Tak News, we remain committed to providing you with the most accurate, timely, and actionable information. Whether you are a seasoned investor or a newcomer to the financial arena, our live blog stands as your gateway to navigating the complexities of the stock market successfully.

The information and image source has been taken from Moneycontrol.com, www.livemint.com, finance.yahoo.com, and www.cnbc.com. For more latest trendy news like this visit our Latest News page.

To contact us please visit our Contact Us page located in the footer menu. For various needy offers and deals of the day you can check out our Best Deals page. To know more about us visit the About Us page in the footer menu. You can also read our Disclaimer, Affiliate Disclosure and FAQs page located in the footer menu. You can also find the Webstory Page in the footer menu to see our latest published web stories.